Types of Businesses

Previous Lesson: Organizational Structure

Next Lesson: Types of Accounts

Before explaining types of business categories, first of all explain business. The word “Business” means the state of being busy. Generally, an organization (combination of resources) entity engaged for making profit. In other words all legal and economic activities undertaken towards achieving organizational objective of an enterprise referred to Business. Different authors define business in their own context; however, central idea is same:

• Every human activity which is engaged in for the sake of earning profit may be called business

• Business may be defined as human activities directed toward providing or acquiring wealth through buying and selling of goods

• An institution organized and operated to provide goods and services to the society, under the incentive of private gain is business

An organization is a group of individuals who come together to pursue a common set of goals and objectives. There are types of business categories: business and non-business. A business organization sells products and/or services for profit. A non-business organization, such as a charity or hospital, exists to meet various societal needs and does not have profit as a goal. All businesses, regardless of type, record, report, and, most importantly, use accounting information for making decisions.

Concluded that, the term business includes all human activities concerned with earning money or it is an activity in which produce or exchange goods and services for mutual gain or profit. The goods and services produced or purchased for personal use are not included in business. There are different types of Businesses, under different basis by different authors. Some forms under some basis are discussed below:

- Business Classification by Operational Activity

This is first business classification for type of businesses. From operational activities point of view business can be classified into three main classes of activities. These activities are as follows:

1.1. Merchandising Activity

This type of business does not change the shape of the goods rather by adding their profit. Business received goods in finished form and sell to customers as it is.

1.2. Manufacturing Activities

The enterprises which are involved in manufacturing activities start their activities from purchase of raw material and put labor and factory overhead on the raw material and develop products. Produced products are looks entirely different from raw material. Hence we can say that in this type of business value addition is carries out.

1.3. Services Activities

The organizations involve in providing service like banking, education, insurance, management development and training are called services activities.

- Business Classification by Sector

Basically there are two sector public and private. The public sector business organizations, for profit or non profit, are the ones controlled by the government. The firms owned by private entrepreneurs are private sector organizations.

Practice related Multiple-Choice Questions Types of Businesses MCQs.

- Business Classification by Legal Structure

In terms of the legal structure, firm can be categorized into the following four categories.

3.1. Sole Proprietorship

A business owned by one person and the owner may operate by own or may employ others. The owner of the business has total and unlimited personal liability of the debts incurred by the business.

Stafford states, it is the simplest form of business organization, which is owned and controlled by one man.

Baker defined as; sole proprietorship is a business operated by one person to earn profit.

An individual may enter into business alone, either selling goods or providing a service. Such a person is described as a sole trader. The business may be started because the sole trader has a good idea which appears likely to make a profit, and has some cash to buy the equipment and other resources to start the business. If cash is not available, the sole trader may borrow from a bank to enable the business to start up.

Although this is the form in which many businesses have started, it is one which is difficult to expand because the sole trader will find it difficult to arrange additional finance for expansion. If the business is not successful and the sole trader is unable to meet obligations to pay money to others, then those persons may ask a court of law to authorize the sale of the personal possessions, and even the family home, of the sole trader. Being a sole trader can be a risky matter and the cost of bank borrowing may be at a relatively unfavorable rate of interest because the bank fears losing its money.

Sole proprietorship is the oldest form of business organization in which one man invests his capital himself. He is all in all in doing his business. He enjoys the whole of the profit or bearing a loss. For accounting purposes, the business is regarded as a separate economic entity, of which the sole trader is the owner who takes the risk of the bad times and the benefit of the good times.

3.2. Partnership

One method by which the business of a sole trader may expand is to enter into partnership with one or more people. This may permit a pooling of skills to allow more efficient working, or may allow one person with ideas to work with another who has the money to provide the resources needed to turn the ideas into a profit. There is thus more potential for being successful. If the business is unsuccessful, then the consequences are similar to those for the sole trader. Persons to whom money is owed by the business may ask a court of law to authorize the sale of the personal property of the partners in order to meet the obligation.

• Partnership is the second stage in the evolution business organization.

• It means the association of two or more persons to carry on as co-owners.

• The persons who constitute this organization are individually termed as partners and collectively known as firm; and the name under which their business is conducted is called “The Firm Name”.

• In ordinary business, the number of partners should not exceed 20, but in case of banking business it must not exceed 10. This type of business organization is very popular.

• The law related to partnership is called Partnership Act.

According to Partnership Act, “Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all.”

Partnership may be established as a matter of fact by two persons starting to work together with the intention of making a profit and sharing it between them. More often there is a legal agreement, called a partnership deed, which sets out the rights and duties of each partner and specifies how they will share the profits. There is also partnership law, which governs the basic relationships between partners and which they may use to resolve their disputes in a court of law if there is no partnership deed, or if the partnership deed has not covered some aspect of the partnership.

For accounting purposes the partnership is seen as a separate economic entity, owned by the partners. The owners may have the same intimate knowledge of the business as does the sole trader and may therefore feel that accounting information is not very important for them. On the other hand, each partner may wish to be sure that they are receiving a fair share of the partnership profits. There will also be other persons requesting accounting information, such as HM Revenue and Customs, banks who provide finance and individuals who may be invited to join the partnership so that it can expand even further.

3.3. Joint Stock Company

The main risk attached to either a sole trader or a partnership is that of losing personal property and possessions, including the family home, if the business fails. That risk would inhibit many persons from starting or expanding a business.

• Joint Stock Company is the third major form of business organization

• It is entirely different organizational from sole proprietorship & partnership

• There are two advantages of Joint Stock Company. First of all, it enjoys the advantage of increased capital. Secondly, the company offers the protection of limited liability to the investors and disadvantage is double taxation (Corporate + Income Tax)

• The law relating to Joint Stock Company has been laid in Companies Act

The most widely quoted definition of a company was given by an American judge, Justice Marshal in 1891, in which he defined a corporation as;

“an artificial being, invisible, intangible and existing only in law”

According to S.E. Thomas; “a company is an incorporated association of persons formed usually for the pursuit of some commercial purpose.”

For accounting purposes the company is an entity with an existence separate from the owners. In the very smallest companies the owners may not feel a great need for accounting information, but in medium- or large-sized companies, accounting information will be very important for the shareholders as it forms a report on how well the directors have run the company.

There are two types of companies which are discussing below.

3.3.1. Public Limited Company

• Company which is formed by a least ‘7’ members, and there no restrictions to maximum number of shareholders

• This company can invite public to subscribe its shares or debentures by issuance of prospectus

• The shares of a public company are freely transferable or subscribe

• The word ‘Limited’ is used at the end of the name of public company

3.3.2. Private Limited Company

• It is a company which is formed by at least ‘2’ members and maximum number of members which is fifty (50)

• A private company cannot invite public to subscribe to its shares or debentures by issue of prospectus

• The transfers if shares is generally restricted by the articles of association of a private company

• In case of a private company, the word ‘Private Limited’ must be used at the end of the name of a company.

In either type of company, the owners are called shareholders because they share the ownership and share the profits of the good times and the losses of the bad times (to the defined limit of liability). Once they have paid in full for their shares, the owners face no further risk of being asked to contribute to meeting any obligations of the business.

Hopefully, the business will prosper and the owners may be able to receive a share of that prosperity in the form of a cash dividend. A cash dividend returns to the owners, on a regular basis and in the form of cash, a part of the profit created by the business. If the company is very small, the owners may run the business themselves. If it is larger, then they may prefer to pay someone else to run the business. In either case, the persons running the business on a day-to-day basis are called the directors. Because limited liability is a great privilege for the owners, the company must meet regulations set out by Parliament in the form of a Companies Act.

3.4. Hybrid

Those combine limited liability advantage of a company with single tax advantages of a sole proprietor/ partnership

3.4.1. S-Type Corporation

• S-Type corporations are limited liability corporations without double taxation

• In a regular corporation, the company itself is taxed on business profits. In addition, the owners pay individual income tax on money that they draw from the corporation as salaries, bonuses, or dividends

• In contrast, in an S corporation, all business profits “pass through” to the owners, who report them on their personal tax returns (as in sole proprietorship or partnerships)

3.4.2. Limited Liability Partnership (LLP)

• Limited Liability Partnership (LLP) or limited partnership is also a form of partnership with allows limited liability to the owners.

• These organizations are similar in many ways to the partnership; however, LLPs offer more flexibility and benefits to the owners.

3.4.3. Personal Corporations (PC)

• Personal Corporations (PC) or Professional Corporations are generally formed by professionals to protect them against litigation. Professionals like doctors, lawyers etc. prefer to register their business as Professional Corporations.

- Non-profit-making Organizations

Other organizations are formed with the intent of providing services, without intending to be profitable in the long term:

4.1. Clubs and Societies

These organizations exist to provide facilities and entertainments for their members. They are often sports and/or social clubs and most of their revenue is derived from the members who benefit from the club’s facilities. They may carry out some activities that are regarded as ‘trading’ activities, in which profits are made, but these are not seen as the main purpose of the organization.

4.2. Charities

These exist to provide services to particular groups, for example people with special needs and to protect the environment. Although they are regarded as non-profit-making, they too often carry out trading activities, such as running shops.

4.3. Local and central government

Government departments are financed by members of society (including limited companies). Their finances are used to provide the infrastructure in which we live, and to redistribute wealth to other members of society. You will not look at the accounts of government bodies in this Learning System.

Practice Types of Businesses Quiz 1 and Quiz 2.

Types of Accounts

Previous Lesson: Types of Business

Next Lesson: Assets

An Account is basic building block of accounting. There are six types of account or accounting pillars used in recording economic activity in a systematic way.

See Contra account

See Golden Rules of Accounting.

Example 1:

For each of the following, write Types of Account and Normal Balance?

SN Accounts Type of Account Normal Balance

1 Cash Asset DR

2 Accounts Payable Liability CR

3 Income Tax Expense DR

4 Inventory Asset DR

5 Transportation cost Expense DR

6 Prepaid Rent Asset DR

7 Sales Revenue CR

8 Note Payable Liability CR

9 Bill Receivables Asset DR

10 Salary Outstanding Liability CR

11 Rent and Taxes Expense DR

12 Common Stock Owner’s Equity CR

13 Sundry Debtors Asset DR

14 Commission (CR) Revenue CR

15 Leasehold Land Asset DR

16 Utility Bills Expense DR

17 Other Income Revenue CR

18 Land and Building Asset DR

19 Insurance Premium Expense DR

20 Payable and Outstanding Liability CR

21 Owner Invested Owner’s Equity CR

22 Drawings Drawing DR

23 Bank Charges Expense DR

24 Salaries received Revenue CR

25 Fuel Expense Expense DR

26 Loan to Employees Asset DR

27 Bank Account Asset DR

28 Wages earned Revenue CR

29 Marketable Securities Asset DR

30 Unearned Revenue Liability CR

Types of Businesses: Everything You Need to Know

A business type determines a company’s organization, types of officers, legal organization, tax strategy potential for shareholders, and level of liability.8 min read

- What Is a Business Type?

- Types of Businesses: What Are They?

- Why Are Business Types Important?

- Frequently Asked Questions

- Steps to Start a Business

What Is a Business Type?

A business type is a company’s legal structure. Most businesses are one of the following:

• Sole Proprietorships

• General Partnerships

• Limited Partnerships

• Limited Liability Partnerships

• Limited Liability Companies

• S Corporations

• C Corporations

• Nonprofit Organizations

• Cooperatives

Types of Businesses: What Are They?

Also known as a business form, a business type determines a company’s internal organization, types of officers, legal organization, tax strategy potential for shareholders, and level of personal liability. These are the most common business types:

Sole Proprietorships

Sole proprietorships are just one individual, and they don’t require licenses, paperwork, or fees to set up. The owner is the business and is personally liable for all debts, lawsuits, and judgments. The owner also reports profits and losses on his or her personal tax returns with a Schedule C.

Sole proprietors can use a fictitious business name that is different from their legal name (also known as a DBA for “Doing Business As”), but they are still personally liable for business debts. Additionally, business loans are based on personal credit history and assets.

Partnerships

Partnerships consist of two or more persons who contribute funds and resources. The partners divide the business’s profits.

• General Partnerships: General partnerships are easy to form and run, as most states require only basic paperwork and licenses. Their structure is similar to sole proprietorships, only general partnerships have two or more owners.

Partnership owners report profits and losses on their personal tax returns and file an IRS Form 1065. They remain liable for business debts and lawsuits.

• Limited Partnerships: Limited partnerships consist of one or more general partners and several limited partners. All general partners remain personally liable for debts and lawsuits unless the general partner is a corporation or a limited liability company. Limited partners are not personally liable, and they may leave without ending the partnership. General partners report profits and losses on their personal tax returns.

These tend to be best for companies that plan to raise capital from investors who do not participate in daily operations. However, they can also be expensive to create.

• Limited Liability Partnerships: Limited liability partnerships (LLPs) consist of general partners who are not liable for the actions of either partners or employees. However, they are personally liable for business debts.

A hybrid of an LLC and a general partnership, an LLP operates with partnership rules but has the same liability limitations as an LLC. Not every state allows for LLPs, and this type may only be possible for certain professions.

• Limited Liability Companies: Limited liability companies (LLCs) have legal and tax structures independent from their owners, and they enable owners to keep personal assets separate from business debts. These businesses can be taxed like a sole proprietorship, a partnership, or an S corporation.

LLCs can have an unlimited number of owner governed by operating agreements. Owners may possess varying percentages of company ownership.

Owners do not have to hold annual meetings or keep minutes. A managing member typically handles day-to-day operations.

• Professional Limited Liability Companies: These are similar to LLCs, except all members must belong to the same profession.

• Series Limited Liability Companies: These allow for parent and sub-LLCs that maintain separate liability.

• Corporations: Corporations keep owners’ personal assets separate from business debts. They must hold annual meetings and keep a record of the minutes.

Corporations are taxed based on profits and shareholder dividends. By sharing profits among owners, corporations may pay lower taxes. There is no limit to the number of shareholders they can have.

Corporations have to document their organizational structure. This can include directors, who make strategic decisions, officers, who handle daily activities, and shareholders, who profit from the business’s equity.

Corporations are smart for companies that want to receive funding from venture capitalists. However, they are expensive to maintain, due to the extensive legal and accounting requirements.

• S Corporations: S corporations (s-corps) set up legal and tax structures independent of their owners, allowing for personal assets to stay separate from business debts. The owners of s-corps report their profits and losses on personal tax returns.

Owners and employees of s-corps may receive salaries. In some cases, only owners who have more than a 2 percent share will receive certain benefits.

Shareholders have to be U.S. citizens or residents. There must be fewer than 100 shareholders. These businesses have to hold annual meetings and keep minutes.

• C Corporations: C corporations (c-corps) have structures separate from individual owners and allow owners to maintain separate personal assets. They are required to hold annual meetings and keep a record of the minutes.

C-corps are taxed on corporate profits and shareholder dividends. They are effectively taxed twice, once on the business side and once on the personal side.

C-corps owners split ownership via shares of stock. There is no limit to the number of shareholders they can have, and they can sell more than 100 shares of stock.

• Professional Corporations: Professional corporations (PCs) are composed of professionals in the same field, such as attorneys or doctors. Typically, each owner remains liable for professional actions and malpractice.

• Nonprofit Corporations: Structurally, nonprofit corporations are similar to standard corporations. However, owners organize nonprofits with a charitable, educational, or community-minded purpose.

Nonprofit corporations can collect donations from the general public. They can also apply for grants and raise funds. Most of the funding that nonprofit corporations receive is exempt from taxation. Donors can deduct donations from personal tax returns.

These organizations must keep any profits to pay for expenses and programs. They must also retain any property they receive or pass it along to another nonprofit.

• Cooperatives: Members own and operate cooperatives, or co-ops, usually with a democratic structure. Most co-ops must have bylaws, membership applications, and a board of directors.

Grassroots organizations often create co-ops with the intention of building a consumer-friendly business. Some states have rules and regulations for co-ops, but not all do. Co-ops can be either incorporated or unincorporated.

Why Are Business Types Important?

Choosing the right business type will enable you to launch your company effectively and start making a profit as soon as possible. Consider the risk of personal liability, potential to generate funding, and ability to produce revenue when deciding which type to launch.

Small businesses help people realize the American Dream. The general public has an overwhelmingly positive view of small businesses, placing them ahead of even churches and academic institutions. As a result, state and local governments often make it easy for small businesses to launch and thrive.

Not all small business are alike. They have a variety of needs and give back to local communities in diverse ways.

While many small businesses are truly small, with just a handful of employees, the definition of a small business is a company with under 500 employees. Altogether, 28 million small businesses across the nation employ about 60 million Americans.

There are four kinds of small businesses:

• Non-Employee Businesses: There are about 23 million of these sole proprietorships. These owner-focused businesses help provide economic mobility, and they appear to be on the rise. Non-employee businesses require very little paperwork, so you can create a business plan and launch your new company quickly. Some examples of small businesses that are easy to start include:

o Arts and Crafts: You can create goods in your home studio and sell them online, at craft fairs, or at local venues.

o Reselling: Acquiring goods and reselling them at profitable prices doesn’t require you to produce anything, but this type of business does demand storage space.

o Skill-Based Services: You can sell skills, such as repair abilities, without having a physical office.

o In-Home Services: When you sell skills in customers’ homes, such as dog walking services, you don’t need a physical base for your business.

o Consulting: This business type enables experts to sell skills, knowledge, and experience in an industry.

o Micropreneurship: Join the sharing economy and take advantage of existing platforms that enable you to sell goods and services.

• Main Street: There are about 4 million small businesses with a local focus. They include restaurants and retailers that populate every city and town in the United States. Most support families and have relatively high turnover rates.

• Suppliers: There are about 1 million small business-to-business companies. They supply goods and materials to other businesses and help companies across the U.S. run smoothly and efficiently.

• High-Growth: There are about 200,000 small businesses that focus on innovation and growth. Also known as startups, these companies create numerous jobs and drive the economy. In Massachusetts, for instance, just 5 percent of the companies drive over three-quarters of growth outcomes.

Frequently Asked Questions

• Are there any other business types to consider? Some business experts consider a company’s primary focus to be its business type. Choose from one of the following four options:

o Service Business: This type of company provides services instead of goods. A service business may offer skills, consulting, or advice.

o Merchandising Business: Also known as a buy-and-sell business, this type of company buys wholesale goods and sells them at retail. Merchandising businesses sell goods as-is and profit from the margin.

o Manufacturing Business: This type of company buys raw materials and uses them to make new products. Manufacturing businesses utilize labor and factory space to transform materials.

o Hybrid Business: This type of company combines one or more of the other three kinds of businesses.

• Where do I register my business? Contact your Secretary of State to learn the process for registering and getting a business license in your state. Note that you can’t form every business type in each state.

• How can I get funding to start a business? Many new business owners apply for loans or grants or raise funds through crowdfunding. In addition, some businesses require very little up-front funding to start.

Steps to Start a Business

- Develop a business plan. Use a template to develop a business plan that outlines your mission, products and services, and revenue stream.

- Decide on a business type. If you’re undecided, ask yourself a few questions to make the decision easier:

• Is your business for profit or nonprofit?

• Do you want to file business taxes with a business tax ID?

• How much personal liability will you take on?

• How much input will your business partners have?

• Will you hire employees?

• Will members own your company instead of a single owner? - Get a business license. If the business type you choose requires a license, file the appropriate paperwork and pay the fees. Get familiar with your local zoning laws if you plan to run a home-based business.

- Secure your domain name. Lay the foundation for your business’s online presence by buying a domain name for your website.

- Create a website. Use a simple website creator application or hire a designer to build a website for your business.

- Make a marketing plan. Whether you plan to generate sales through pay-per-click (PPC) ads, social media platforms, or print and broadcast ads, you need a marketing plan.

- Buy business equipment. From computers and technology to office furniture and supplies, make sure you have what you need to run your new business.

If you need help with business formation, you can post your question or concern on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

What Are the 4 Types of Business Activities?

JoneJanuary 10, 2022

0 177 2 minutes read

What are the 4 types of business activities? Businesses are categorized into operating, investing, and financing activities. Operating activities are the ones that affect the performance of a company most directly. All businesses fall into one of these categories: industry and commerce. Industry is the creation of products and services for sale. There are two types of industries: primary and secondary. In both cases, the primary activity is selling products to consumers. A secondary activity is creating and selling other kinds of goods or services. How can you know about worldtravelplace.net best website wapkingzone.com And more site visit here bestnewszone.com.

Read More About: creativblog

Click Here: f4zone.xyz

The first type of business activity is the production of goods and services. It involves the creation of an intangible good or service in return for labor or other services. Service businesses include interior decorators, tanning salons, dry cleaners, pest controllers, and others. Financial services businesses offer loans, investments, and other financial services to consumers. Real estate investment trusts, pension funds, and private equity firms are examples of these businesses. Transportation businesses transport goods for a fee.

7satrhd

Click hear : mynewsweb

Read More About: Naa Songs

The fourth type of business activity is financing. In addition to providing goods or services, these organizations also provide financial services to consumers. While investing is a major activity, it is not profitable. The goal of every business is to maximize profits, so businesses must carefully consider the costs and benefits of each activity. This will help ensure that the money they generate will remain in the company. For those in the construction industry, construction companies are a great option.

Read More About: gamingnews Visit The Site: todayeduhub Visit Here: besthealthnews

Visit This Site: thenewsbuzz.org

The highest-ranked business activity is customer satisfaction. This is the most important type of business activity, and it starts with production and moves to product management, marketing, and sales. After-sales service is also important. Moreover, customer satisfaction is one of the most important metrics in determining the profitability of a company. If the process of creating a product is not pleasing to the customers, it won’t be profitable at all. Visit this site: malluwap

Latest website cbdfordogs and kmaa8 More information aybabag

The fourth type of business activity is operating. These activities provide tangible goods to customers. However, service businesses typically charge for labor and other services. These businesses may be service businesses, such as interior decorators, laundromats, dry cleaners, and pest controllers. Intangible goods, which are usually sold in retail stores, are manufacturing and distribution businesses. Intangibles are also a form of business. Read more about: maangome

Click here : holla

Visit this site: ablo.info

Read more about: ifusi

If You Need More Information’s check This Link: forbesnewsblog.com

information Visit the Site : webnewsrate.com

Visit The Site bloggersnews and activesnet

Besides manufacturing and sales, companies also engage in various activities to create products and services for customers. In general, these activities are grouped under one of the four categories of business activities. Depending on the nature of the activity, a company may have several different types of activities. If a company focuses on customer satisfaction, it is considered to be a successful business. Its customer-centric approach to product development and marketing creates value for shareholders. For more information visit this site: forextradenews

Click here for more information: gamesupdate24

Visit this site for more information: usazonenews

Latest Website happy2hub and worldupdate More information Visit the Site liangzhongmiye

vscialisv Click This Link

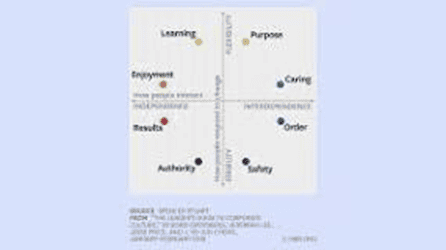

8 Most Common Types of Workplace Cultures

• Adhocracy Culture.

• Clan Culture.

• Customer-Focused Culture.

• Hierarchy Culture.

• Market-Driven Culture.

• Purpose-Driven Culture.

• Innovative Culture.

• Creative Culture.

What are the 8 types of company culture?

What are the 8 types of company culture?

• 1 Caring workplaces. Caring cultures are collaborative and welcoming. …

• 2 Purpose-driven cultures. …

• 3 Learning cultures. …

• 4 Playful work environments. …

• 5 Results-oriented cultures. …

• 6 Authority cultures. …

• 7 Safe and risk-conscious cultures. …

• 8 Structured and methodical work environments.

Culture, and International Trade

As with any international business relations, uncontrollable factors such as politics, economics, social, technological, legal and environmental can and will influence trade. Social refers to the cultural aspect of import and export, as cultural variations distinguish one foreign market from another.

Understanding these cultural differences can make or break whether a foreign trade opportunity will be successful or not. The culture of a country will have a direct influence on how business is conducted and how negotiations should be handled.

In Module 4 of the University of Cape Town Import and Export Management online short course, you gain the understanding of different cultural nuances to give your trade negotiations the best chance of going through.

The levels of culture

Culture functions on a multitude of levels, making cross-cultural, cross-country business and trade more complicated than learning how to greet a potential business partner. It’s especially necessary to learn these nuances as the world becomes more globalised, and the international trade becomes more empathetic to expressions of culture.

Culture can be broadly separated into four levels:

- National culture.

- Industry culture.

- Company culture.

- Individual behaviour.

National culture

This would be the broadest level of cultural influence. When doing business in a foreign country, negotiations are influenced by national cultures, as well as the regulations and laws that govern each country.

[bctt tweet=”When doing business in a foreign country, negotiations are influenced by national cultures, as well as the regulations and laws that govern each country.” username=””]

Industry culture

This level is influenced by behavioural norms and practices within industries, in the context of national culture. It’s often the case that cultural norms can transcend national borders and become more indicative of the industry rather than the origin or place.

Industrial products, rather than consumer products, are less influenced by a country’s culture than by industry norms and standards.

Company culture

Companies are much like people, they each have their own sets of values, morals, beliefs and opinions. As well as their own dress codes, standards of communication, norms and expectations on tone and register.

Another level of company culture is intra-departmental. For instance, the finance department will have a completely different vocabulary for internal and external communications than the jargon marketing would use.

Individual behaviour

The individual employees of an organisation will operate on this level of culture. It’s influenced by all the above levels, and sees the influence of the other levels in practice. It’s the personal expression of all other cultural beliefs.

People who aren’t employed, however, are influenced by national culture and the subculture of the social group of which they’re a member.

In an age where organisations and people are being brought together closer than ever before, it’s important to understand and respect the cultures and beliefs of others. Especially if you’re hoping to do business with them.

Learn to adapt to the increasingly global marketplace.

Tap into new markets and maximise trade opportunities with the UCT Import and Export online short course.

Leave a Reply